When Financing Becomes the Growth Engine

Most dentists assume their biggest barrier to growth is marketing, new-patient flow, or insurance reimbursement.

Dr. Blake Hamblin thought the same – until he discovered how patient financing reshaped every part of his practice.

In one year, his production jumped from $200,000 to $500,000 a month. His team was happier, patients were happier, and the business finally had predictable growth.

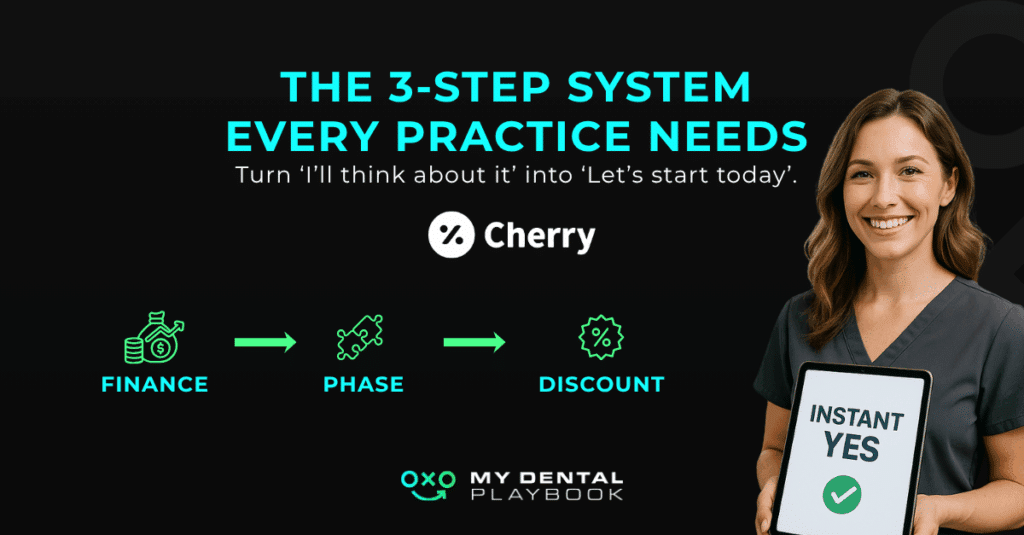

The difference wasn’t another campaign. It was a simple three-step framework: Finance, Phase, Discount.

Step 1: Finance – Make “Total or Monthly” the New Normal

The biggest shift came from how treatment was presented.

Instead of quoting only the total, “Your treatment is $7,000”, Paige began saying,

“Your treatment is $7,000, or as little as $50 a month.”

That single phrase reframed the conversation. Patients immediately saw possibility instead of panic.

Using Cherry Technologies, known as Cherry Financing, Paige could pre-fill a patient’s information and send a quick text link. Within 3–5 minutes, she received an approval while the patient was still sitting in the chair. Momentum never broke.

Even partial approvals mattered. “If they get $500 for a $7,000 plan, that’s okay,” Paige shared. “We start small, complete that portion, and Cherry often raises their limit once it’s paid off.”

For dentists still hesitant about fees, Dr. Blake puts it simply:

“You’re already paying 3% to 4% on credit cards. A small financing fee is nothing compared to the treatment walking out the door.”

Step 2: Phase – Keep Cases Moving Forward

Partial approvals aren’t failures; they’re progress.

With the Phase approach, Dr. Blake’s team sequences treatment to match what the patient can manage right now.

Example: a $7,000 plan becomes $1,000 of immediate care financed through Cherry, followed by the next phase once that’s paid down.

Patients build credit and trust while the office keeps production steady. Each phase strengthens loyalty and retention. They return not only for hygiene but to finish what they started, because someone finally made it affordable.

Step 3: Discount – A Tool, Not a Default

Discounts used to be Dr. Blake’s first lever. Now, they’re his last.

When a patient truly can’t finance or phase, Paige has the authority to make a reasonable adjustment that keeps treatment accessible without damaging margins.

“Her job is to close the treatment,” Dr. Blake says. “Finance, Phase, then Discount, in that order.”

This mindset keeps profitability intact and gives the team clarity on when and why to offer incentives.

The Data Behind It: Why 20% Financed Production Is Healthy

According to industry benchmarks, thriving practices often finance 20% or more of their total production.

When financing is this integrated:

- Treatment acceptance rises 30-40%

- Case size increases because patients can say yes to complete care

- Marketing ROI improves – more booked appointments convert to treatment

- Team confidence grows because they know how to help every patient find a path forward

Financing isn’t just about affordability; it’s a growth multiplier that touches every key metric in the business.

How to Present Like a Pro

Paige’s 3-5 Minute Approval Flow:

- Quote the total and the monthly cost together.

- Ask, “What monthly amount feels comfortable for you?”

- Pre-fill their Cherry application while they’re still in the room.

- Confirm approval and start scheduling immediately.

Her approach blends empathy with efficiency, a skill every treatment coordinator can master.

As Gary Bird notes,

“It’s not sales. It’s listening. When you mirror the patient’s emotion, they feel heard and supported.”

Try It for One Month

Dr. Blake challenges every dentist to a simple test:

“Run one month without patient financing. Then one month with it. Compare your production and take-home pay.”

There’s no long-term risk, just measurable results. In nearly every case, practices earn more, accept more treatment, and experience higher morale.

Why This Matters Right Now

Financing isn’t new. Every major industry uses it, from Apple to hotels to elective medicine. Patients already expect flexible payments. Dentistry is one of the last holdouts.

Adopting it early gives your practice a competitive advantage. It’s not about becoming a financing office; it’s about removing the friction that keeps patients from saying yes to the care they already want.

Key Takeaways

- Present total and monthly every time. Patients buy when they understand options.

- Use Finance-Phase-Discount to keep production steady. Every patient gets a path to yes.

- Track financed cases as a KPI. If less than 20% of production is financed, you still have growth potential.

Want Help Building a Strategy Around It?

If you’re ready to connect your financing system with smarter marketing, schedule a complimentary 15-minute discovery call with SMC’s team.

You’ll receive:

- Income & Population Maps for your exact zip codes

- Competition Analysis to see where you stand

- Growth Benchmarks to set clear production goals

No obligation, just insights you can use immediately.

Schedule Your Discovery Call Now

Final Thought

Dr. Blake says it best:

“Don’t let financing live on a shelf. Lead with it. It changes everything.”

The 3-Step System Every Practice Needs isn’t theory; it’s a tested framework producing measurable growth.

When you make it easy for patients to say yes, your practice wins right alongside them.